I often hear a financial planner saying it’s difficult for them to demonstrate their value until the clients experience their service. And I understand that we’d all test drive a car before agreeing to buy it. Unfortunately, we can’t so I’ve put this blog and short video together to explain what financial planning is.

To help us we use some software called Cash Calc, you can find out more about them here. By uploading detailed information on assets, expenses and income we can project your financial future. It’s important that the information is accurate, so no underestimating your wine bill. We use that information to estimate what your lifestyle might cost in the future. Think of it as an ageing app for your finances.

Once we’ve uploaded the information we need to make some educated guesses on things like inflation and growth, and any milestones you might have, happy stuff like retirement and less cheery things like your mortality. Now we can see what your financial future looks like.

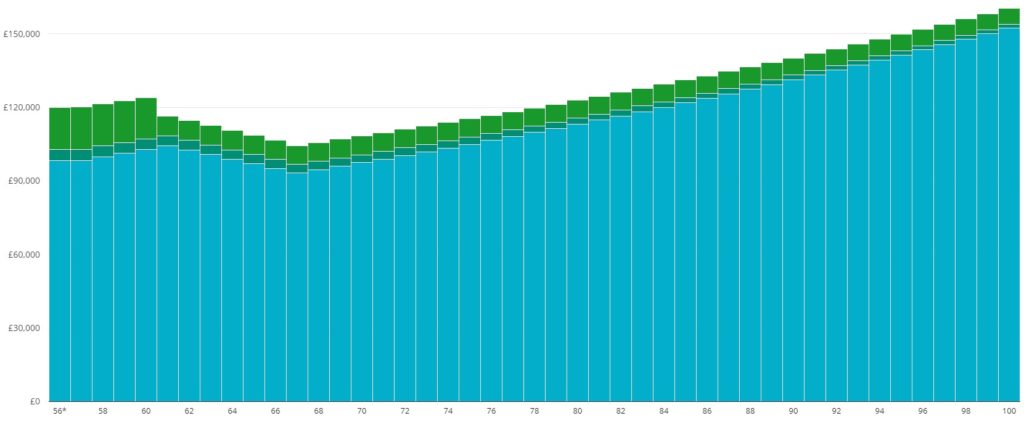

This chart shows your savings all the way until age 100. You can see how they increase until age 60 when this client would like to retire. They rely on their savings for a few years until the state pension becomes payable when their pot begins to grow again. Each coloured bar represents a different savings pot.

Once we have a draft plan the system allows us to create alternative scenarios. Perhaps you’d like to retire early or spend a little more on travelling. It’s easy to do.

Once we have decided on a course of action we produce your bespoke Financial Plan, you can see an example here. We update it at your annual financial planning meeting to make sure you stay on track. And using our knowledge of pensions, investments, tax and savings we make sure your plan becomes a reality.

We offer a free financial health check, you can book a meeting with a financial planner using this link https://calendly.com/ian4fp/discovery-meeting and find out what makes us different here.