It turns out an Apple a day does keep the doctor away, although this is not strictly true. It actually keeps the undertaker away. Here’s how a watch and private health care helped one of my best friends stay alive.

One of my best friends is a bit of a geek. She has all the latest gadgets, she works in IT doing something I don’t understand and even has a 3D printer just like Raj and Howard from The Big Bang Theory. Unfortunately, she suffers from less than perfect health. It turns out that the problems could be genetic, as her father dropped dead at a young age with an undiagnosed heart problem.

My friend has suffered from what can only be described as occasional heart palpitations which, knowing your father died of a heart condition as she does, must be scary. Unfortunately, despite seeing numerous cardiologists and being wired up to an ECG on several occasions, the medics have never witnessed the issue and thus have been unable to diagnose it. Until now, when being a geek probably saved her life.

On 18th September 2020 Tim Cook, Apple Inc. CEO, announced the Series 6 Apple Watch. In the words of the marketing team at Apple the watch has your heart in mind. Here’s what they say about it.

“Unusually high or low heart rates and irregular heart rhythms (known as arrhythmias) could be signs of a serious condition. But many people don’t recognise the symptoms, so the underlying causes often go undiagnosed. Notifications in the Heart Rate app will alert you to these irregularities so you can take action and consult your doctor”

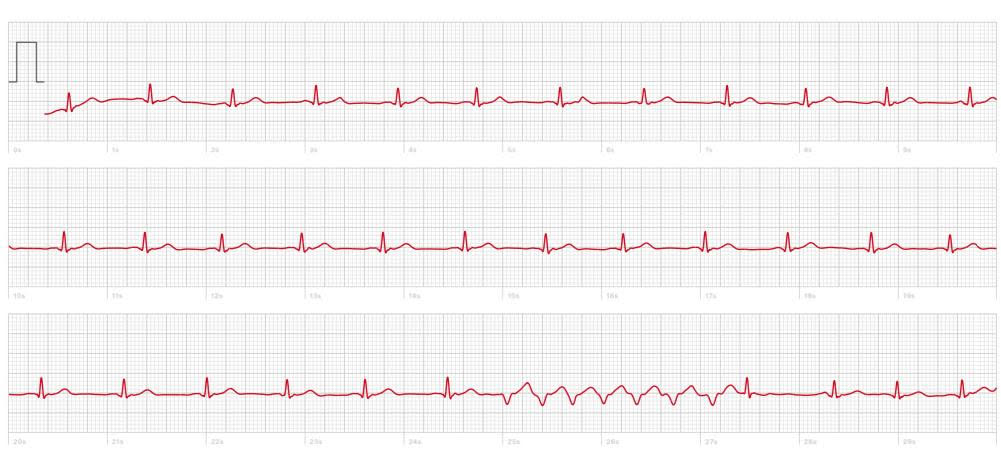

So, being the geek that she is, my friend pre-ordered the watch and was very excited to tell me all about it. I wasn’t particularly impressed (being a financial planner) but this all changed when she sent me this screen shot.

I’m sure we have all watched an episode of Casualty and recognise a heartbeat on a chart, but you don’t need to be a trained medical professional to figure out that there is something wrong with the bottom line. The Apple Watch had managed to catch a heart problem the cardiologists couldn’t. She spoke to her GP, sent them, a copy of the chart and was eventually diagnosed with something called Ventricular Tachycardia. It could have killed her at any time. The Apple Watch literally saved her life.

You might be wondering what an Apple Watch and a heart problem have to do with financial planning? Well, here’s the thing, being a financial planner, an holistic financial planner, means you don’t just focus on investment. We look at every aspect of your financial situation. Yes, that means pensions and investments, but it also includes expenditure, estate planning and, importantly, protection. You can read more about holistic financial planning in this blog.

What is Protection?

It means protecting yourself against anything which could have a financial impact on your life. Generally, that means life assurance, critical illness, income protection and health insurance.

Insurance is a funny thing, It just seems like an expense, right up until you make a successful claim.

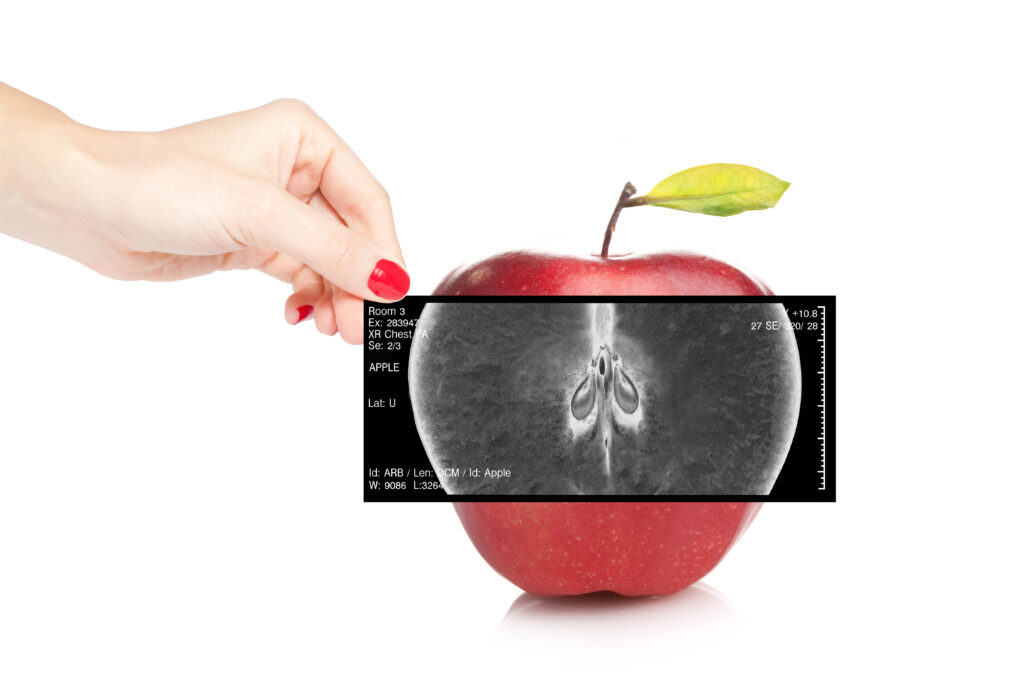

In my friend’s case, we were just heading towards the eye of the second peak of the Covid-19 pandemic and hospitals were filling up. Fortunately, she has private health care. She was MRI’d by a cardiologist fewer than seven days after seeing the GP and, after several decades of worry, she is undergoing treatment.

The moral of this story.

Technology is going to change medicine beyond all recognition over the next twenty years. Problems will be identified before any symptoms have exhibited themselves. This will take some strain off our medical professionals and save lives. It will also mean people live longer but in poorer health.

Protecting yourself against the unexpected is still one of the cornerstones of financial planning. When was the last time you reviewed your protection needs? Are you confident your loved ones would be financially secure if you were unable to work or, worse still, died?

4 Financial Planning offer a free protection review service, you can book an initial consultation here.