I was speaking to a friend recently who had really struggled during the Covid crisis and lockdown. I’m sure many of you reading this can sympathise. As an IFA with a new business, I certainly haven’t been immune to the situation. I told them I thought every generation goes through some sort of crisis, for my parents it was the Suez oil crisis and the very real prospect of nuclear war and for my Grandparents WWII. So I’m trying to be positive that this hasn’t been as horrific as an armed conflict.

I’ve always believed we learn most about ourselves during difficult times and 2020 is no exception. Here are some lessons or reminders from 2020.

Clients need reassurance

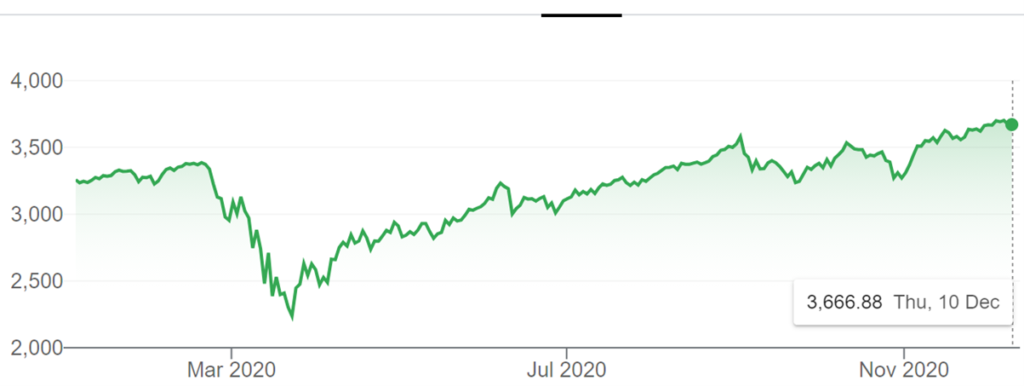

Global stock markets took a battering during the first half of the year. The North American S&P 500 dropped from 3386 points in February to 2237 just over a month later, that’s a fall of over 30%. The UKs FTSE 100 wasn’t far behind either.

That impacted our client’s portfolios, combined with negative headlines and social media, it was a nerve-wracking time for them. A good IFA educates their clients and constantly remind them that even if they haven’t seen a market correction before, they are guaranteed to see one sooner or later. They are encouraged to ignore the short-term noise and focus on the bigger, longer-term plan. I’m sure some of them considered withdrawing from the markers and running for the hills with their cash, but that would have been an expensive mistake. As I type this the North American S&P 500 is currently at 3762 points. Disinvesting only crystalises the loss and the smart investors ride out the storm. That’s why is so crucial that we assess our client’s tolerance for risk and ability to withstand losses correctly at the outset, and make sure it’s regularly updated.

A lesson for us all that the two things that derail the majority of robust financial plans is fear and greed.

Business owners can support the wellbeing of their employees

If one thing has stood out for me during lockdown it’s the inherent kindness of most people. No one has been immune to the anxiety and stress which has been caused by lockdown, but neighbours and friends have rallied around to support one and other.

This has been the same in the business community, with employers furloughing their staff but making up the lost 20% and even if they haven’t been furloughed working hard to help their employees transition to home working. All employers provide benefits to their employees, even if it’s just the auto-enrolment pension scheme, but Covid has encouraged many more to look at other potential benefits. The one which stands out is private healthcare which would support their employees not only through injury or illness but also mental health problems like depression and anxiety that so many have suffered from during lockdown. There are many benefits to private medical care which are often overlooked.

Tax increases can be avoided

Last month, the Office for Budget Responsibility (OBR) predicted the government will borrow £394 billion in 2020/21, as a result of the pandemic. That debt will need to be paid somehow.

Two of the likely candidates for increases are capital gains tax and higher rate pension tax relief. It has never been more important to understand what available allowances you have and use them efficiently.

Be Kind

I hope this isn’t a lesson we needed to learn, but perhaps just reminded of. More than anything during the Covid crisis I’ve been reminded of the importance of kindness and friendship.

The value of an IFA

When times are tough people are more likely to seek advice from an IFA. Covid has changed the mindset of many people and they are not taking their free time for granted any longer. For those people who are looking for an improved work/life balance the need for sound financial advice has never been greater.

There have been several recent studies around the additional value a financial adviser provides. A recent study published by Royal London concludes that those people who take financial advice are on average £47,000 better off over a decade than those who don’t. The findings also state

“The benefits of financial advice are potentially greater for those we term “just getting by” than for those we consider “affluent”

If you’re not sure if you can afford financial advice, perhaps you should be asking if you can afford not to have it?

Source: Royal London

How can 4 Financial Planning help you?

So, financial planning adds value. But why should you choose 4 Financial Planning?

We focus on just the essentials which are you and your money and use technology to streamline the process and charge less than a traditional IFA which means more of the returns stay in your pocket and you don’t need to have a small fortune to work with us. Here’s a video on what makes us different.

Get in touch

If you think you might benefit from our advice, you can book an initial consultation, which is at our cost here or call us on 0117 457 9945

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.