You probably recycle your rubbish, try not to use too much single-use plastic, take a reusable cup to Starbucks. Perhaps you even have an Electric vehicle. What benefit is that if you’re not investing ethically, in companies who have similar values as you? You might be surprised about the sort of companies that make the average portfolio, however, you have a choice, you can invest ethically too. Using investments that reflect your own values and aim to do good for the planet and the 7.6 billion people who inhabit it. Investing ethically is not straightforward. Everyone has different values, one person might not mind having the alcoholic drinks manufacturer Diageo in their portfolio, others might. And don’t even start me off with the number of acronyms there are. In this guide, we will try and help you navigate the ethical investing waters and terminology.

UN Sustainable Development Goals

In 2015 the UN agreed on 17 interlinked global goals all with the aim of providing a more sustainable future. This includes goals to ensure no one is hungry and everyone has access to clean water. Goal 7 is to ensure everyone has access to cheap and sustainable energy and 13 (hopefully not unlucky) is to urgently combat climate change and its impact. If you’re a business owner reading this you have a responsibility too. If you want to work towards becoming carbon neutral www.go-positive.co.uk are doing great work helping SMEs in this space.

Types of Ethical Investments

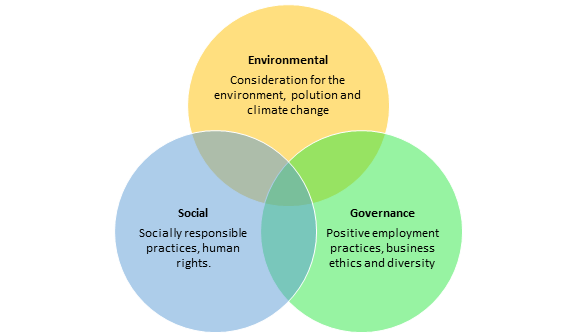

ESG – Environmental Social Governance. ESG is often used interchangeably with ethical, sustainable or socially responsible investing, however, while sustainable and socially responsible investing are very similar, ESG differs in several ways. ESG is a unique term to the fund management industry and one definition is “The consideration of environmental, social and governance factors of a company alongside the financials”. However, ESG can mean different things to different people. Any ESG investment aims to give equal importance to returns as it does values. This is in contrast with Sustainable Investing where the priority is the ethics and values of the portfolio and returns are a secondary consideration.

ESG

Environmental – Consideration for the natural world

- What are the company’s climate change policies, plans and disclosures?

- How is the company meeting its goals for reducing its carbon footprint?

- Water-related issues such as overfishing, conservation and waste disposal.

- Do they use renewable energy wherever possible?

- Are they investing in greener products, technology and infrastructure?

- What procedure do they have for using recycled materials and making their products fully recyclable?

Social – Consideration of people and relationships

Social topics a based around the impact a company has on its employees, customers and consumers.

- How do they treat their employees, what is the pay like, what other benefits to they provide such as healthcare and pensions.

- Are their employees engaged and can they demonstrate a low staff turnover

- What policies are in place for training, development, health safety and sexual harassment.

- Do they employ a diverse team, with equal opportunities or minorities

Governance – Standards for running the company

- What whistleblowing policies are in place?

- Executive compensation

- Lobbying & Political contributions

- Audit Committee

- Bribery & Corruption.

Reasons for ESG investing

People have different reasons for wanting to explore ESG and investing ethically. As a business, we have our own reasons for having it at the core of our proposition. However, whatever the individual reason is we see them gravitate to three main areas:

Investment Returns

Growing research suggests that businesses that score more highly in each area of ESG perform better than their lower scoring counterparts. ESG factors can be used to identify companies with better governance and also used to flag businesses that may face headwinds over time.

Personal Values

Many see ESG as a way of aligning their investments with their ethical, religious or political beliefs. Using ESG as a way to exclude some controversial activities such as tobacco, arms manufacturing or fossil fuel mining and exploration. Values-based goals are intentionally aligned to match an investor’s ethical beliefs.

Positive Impact

The third group of investors focuses on the impact of their investments on the world around them. They may look to seek out businesses that focus on renewable energy or companies that provide solutions to climate change.

SRI – Socially Responsible Investing

SRI places a bigger emphasis on ethical criteria. They look to invest in companies that have a positive social impact. And would usually discount alcohol, tobacco and arms manufacturers. Additionally, they actively seek out companies that are engaged in environmental sustainability, e.g., renewable energy such as wind farms. Financial returns are still at the core of their proposition, but not at the expense of their ethical values.

4 Financial Planning

It has become clear that our recommendations for client’s investments can have a positive or negative impact on the world around us. When we founded the business, it was because we felt there was a fairer way of offering financial advice, making it more affordable and reaching more people. It seems natural for us to take that sense of fairness one step further, so our core offering is ESG portfolios. We continue to have non ESG investments available and we will discuss whether investing ethically is the appropriate solution for you.

If you would like to understand more about Independent Financial services and how your money can do good, we offer a free initial consultation you can book here.