As a financial adviser if I get asked one question more than any other it’s how much do I need to save to be able to retire comfortably. The answer is always “it depends”. For most people working it out doesn’t need to be too complicated. The hard part is stopping fear and greed derail your best intentions.

I wanted to share some of my tips to help you work out your “number”. There are also some great books out there which will help you, one of my favourites is The Meaningful Money Handbook by Pete Matthews. And if you still need more help you can book a free initial consultation with me here.

Tip #1 – What do you Spend?

If you have one of the modern banks download your expenses to an Excel spreadsheet. If you’re with one of the older banks, use your bank statements and list every single line of expenditure. I normally suggest a minimum of 6 months worth just to make sure you don’t miss any larger payments for things like holidays. Once you have a list of your current expenditure you need to go through it line by line and decide what is and what is not going to be there in retirement. Things like council tax and utility bills are likely to stay, whereas things like costs for commuting to work might not. You probably have plans for your retirement, so some costs might increase, for example travelling. At the end of the exercise, you should have an estimate of your first years’ annual expenditure in retirement.

Tip #2 – Don’t Forget Inflation!

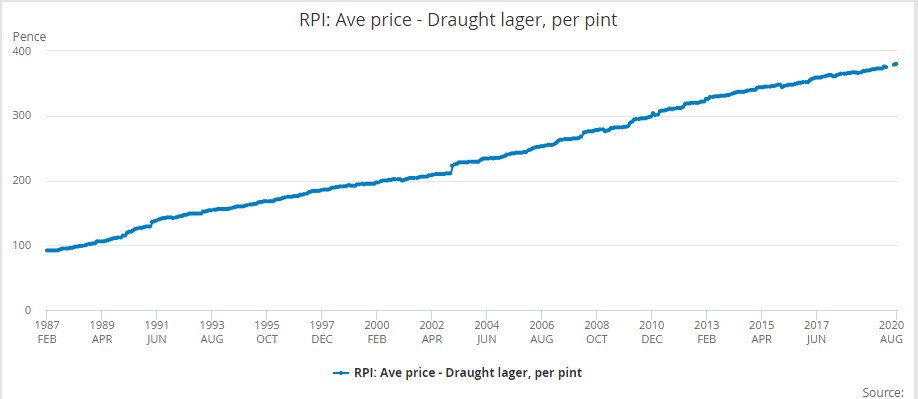

Once you’ve worked out what you think you’ll be spending in today’s money you need to make an adjustment to allow for inflation. To understand how critical this is let’s look at the cost of a pint over the years.

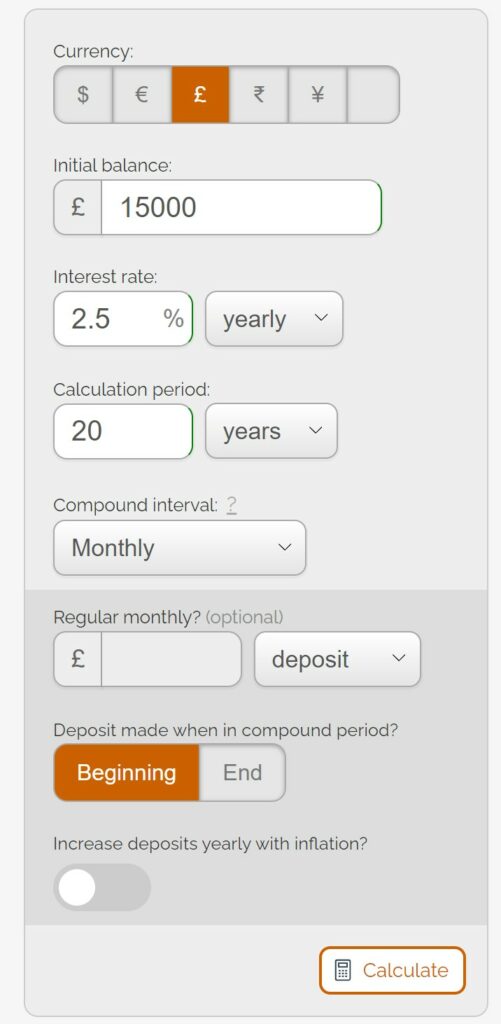

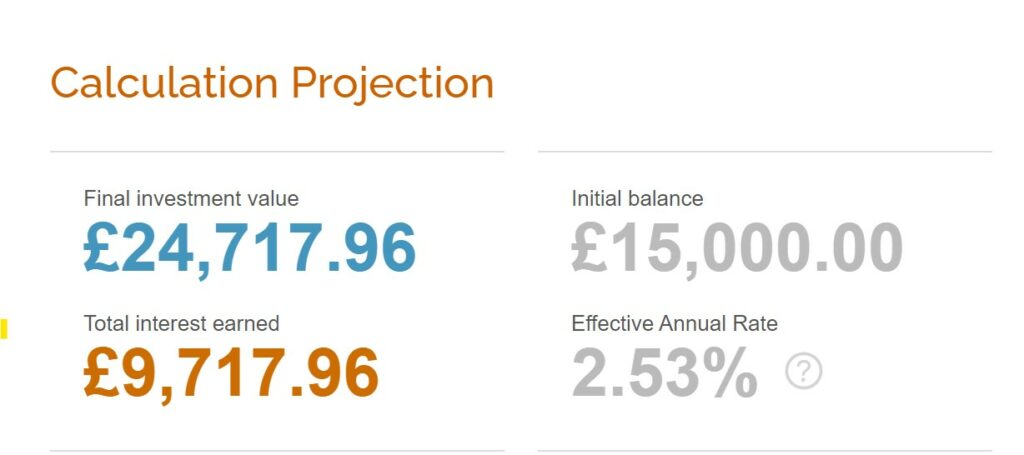

Since 1991, the year I was officially allowed in a pub to buy a pint to now the cost of a pint has increased from £1.38 to £3.79. An increase of 176% over 29 years. Ignore the impact of inflation at your peril. No one has a crystal ball to enable them to predict the future, but when we produce cash flow models at 4FP, we tend to use 2.5%. Bear in mind, this needs to be compounded, this is a calculator to help you. Enter the number you worked out in tip #1, add 2.5% pa and the number of years before you plan to retire.

Now we know that you need the equivalent of £24,717 a year at retirement .

Tip #3 – What’s your Number?

Once you have an estimate of your retirement expenses adjusted for inflation things get difficult. You need to work out what size pot is needed to support those expenses. As a rule of thumb, for a medium risk portfolio, a 4% withdrawal rate is sustainable* from aged 65. However, there are so many unknowns it’s crucial to review your withdrawal strategy at least annually and don’t forget your investments can go down as well as up.

So we’ve got your number, to support £24,717 per annum, increasing in line with inflation you would need a pot of £618,675. Sounds like a lot right? Actually saving £310 per month over your working live would do it, doesn’t sound so bad now?

Tip #4 – Speak to a Financial Adviser

So far so good, working out the number is the easy part. The science is building a robust plan to get you there. A financial adviser will help you get to your “number” and then put a financial plan in place to make that plan a reality. There are so many assumptions needed for growth, inflation and mortality, this isn’t a set and forget plan. It should be regularly reviewed to make sure you stay on track and take action if you are off course. A financial adviser will also stop fear and greed derailing your financial plan. Find more about how 4 Financial Planning can help you here.

*The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.