I met with a potential client who was paying Ad-Valorem fees recently and it got me thinking about the real impact of them against fixed fee financial planning.

What’s Ad-Valorem?

New Latin ad valōrem “according to the value” Broadly speaking this means a charge based on your asset size, a percentage charge. The bigger your pot of money the more you pay. Or as Paul Lewis from BBC Radio 4’s Money Box programme calls it “A wealth tax”.

What’s the Real Cost?

This client had a good grip of their finances and although their pot was modest, they had a good job and were making sizeable contributions. I decided analysis the difference in their pot after 20 years between the two types of charges.

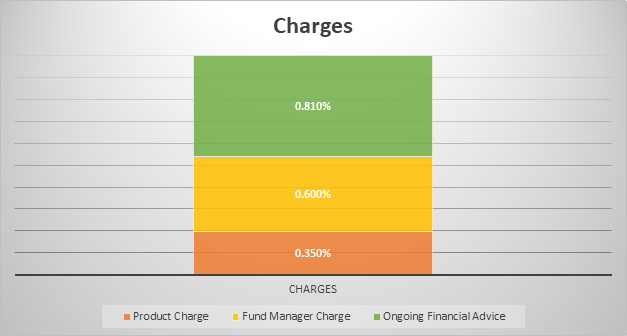

Traditionally in the advice process, there are three layers of charges. First, there’s the product charge, next, the fund manager makes a charge and then finally, if you’re engaging with a financial advisor, they would have their ongoing charges. Overall, you can expect to pay between 1.5% to 2.5% all-in.

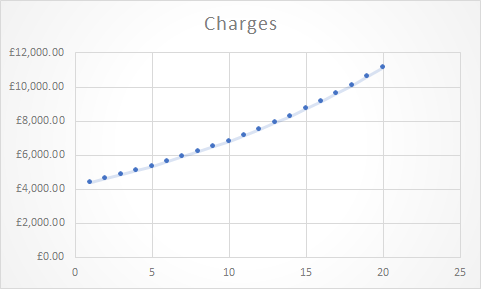

Studies have shown that the general level of numeracy in the UK is poor. People struggle to understand percentages and to convert those percentages into a monetary value. So I’ve done that for you. So let’s have a look at some figures, assuming a £250,000 investment for the next 20 years.

They look pretty reasonable, to begin with. But after 20 years they’ve increased by £6,000. The bad news is providers and fund managers still charge percentage fees, but if you look hard enough you’ll find firms offering fixed fee financial planning.

The Benefits of Fixed Fee Financial Planning

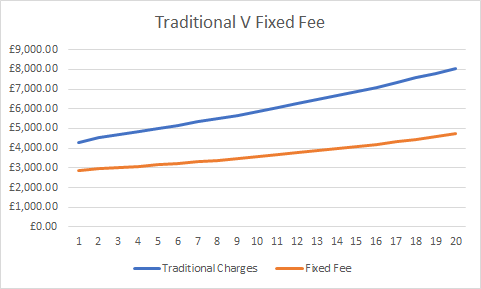

Let’s compare our fees against some of the traditional advisors that are out there. You can see that they start off similar at the beginning, but because the advisor fees are growing, over a course of 20 years it makes a real difference. In fact, it makes £51,000 worth of difference. Now, I don’t know what you could do with £51,000. But to me, that sounds like you could probably retire a couple of years earlier than you planned.

Summary

I’m not saying percentage fees are necessarily a bad thing. I’m just saying, be aware of the impact those charges have on you. When you’re talking to a financial advisor for the first time, ask some questions. Ask them if they offer fixed fees. And if you’ve got a current financial advisor, have a look at those fees that you’re being charged. Make sure you’re getting value for money.

4 Financial Planning offer a free investment health check. You can schedule a meeting using this link and find out what makes us different here.

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested.