In the second of this two-part series, we look at pension carry forward. Carry forward allows any unused annual pension allowance from the previous 3 years to be used in the current tax year. Be warned, the calculation and eligibility rules are complex, we would always recommend you consult with a financial planner.

What is the benefit?

Over time there has been a downward trend of the amount you can contribute to a pension. Starting in 2010/11 when the allowance was £255,000, which was reduced to £50,000 and then £40,000. If you are a high earner it’s possible that you can contribute as little as £4,000 each year due to the tapered annual allowance. Carry forward was introduced in 2011 and gives the ability to increase your pension contributions if your finances allow by using previously unused allowances.

Who can use pension carry forward?

You must have been a member of a UK registered pension scheme for the years you want to carry forward from, this can be either a defined contribution or benefit scheme, although it isn’t necessary for you to have been contributing to them during that period.

If you have triggered the Money Purchase Annual Allowance (MPAA) you are unable to use carry forward.

How pension carry forward works?

Step 1

Make sure you use the current years allowance first. This is the place I see the majority of mistakes being made. If you haven’t used the maximum allowance for the pension input period, which for the current tax year is £40,000 you can’t carry forward unused allowances from previous years. If you’re impacted by the taper, you need to have used all of that.

Step 2

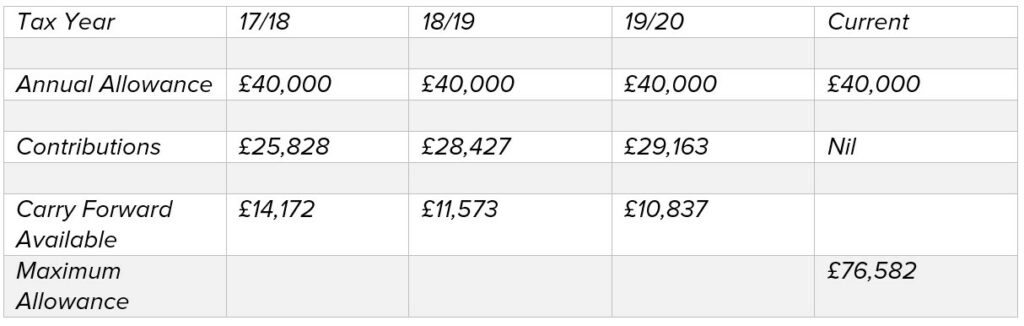

Calculate your pension contributions for the previous 3 years.

Example

Although you don’t have to inform HMRC or the pension provider that you have utilised carry forward we would always recommend you keep records.

4 Financial Planning

We focus on just the essentials which are you and your money. By using technology to streamline the process we can charge far less than a traditional IFA which means more of the returns stay in your pocket and you don’t need to have a small fortune to work with us! Here’s a video on what makes us different.

If your in Bristol, and are looking for an Independent financial advisor, you know who to call!

Get in touch.

If you think you might benefit from our advice, you can book an initial consultation, which is at our cost here or call us on 0117 457 9945

A pension is a long-term investment. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor. The information in this blog is based on the 2020/2021 tax year.